Monthly Accounting

Stripe Payouts

Stripe does a monthly payout, but this amount does not correspond logically to any subset of payments. Therefore, the following procedure is set up:

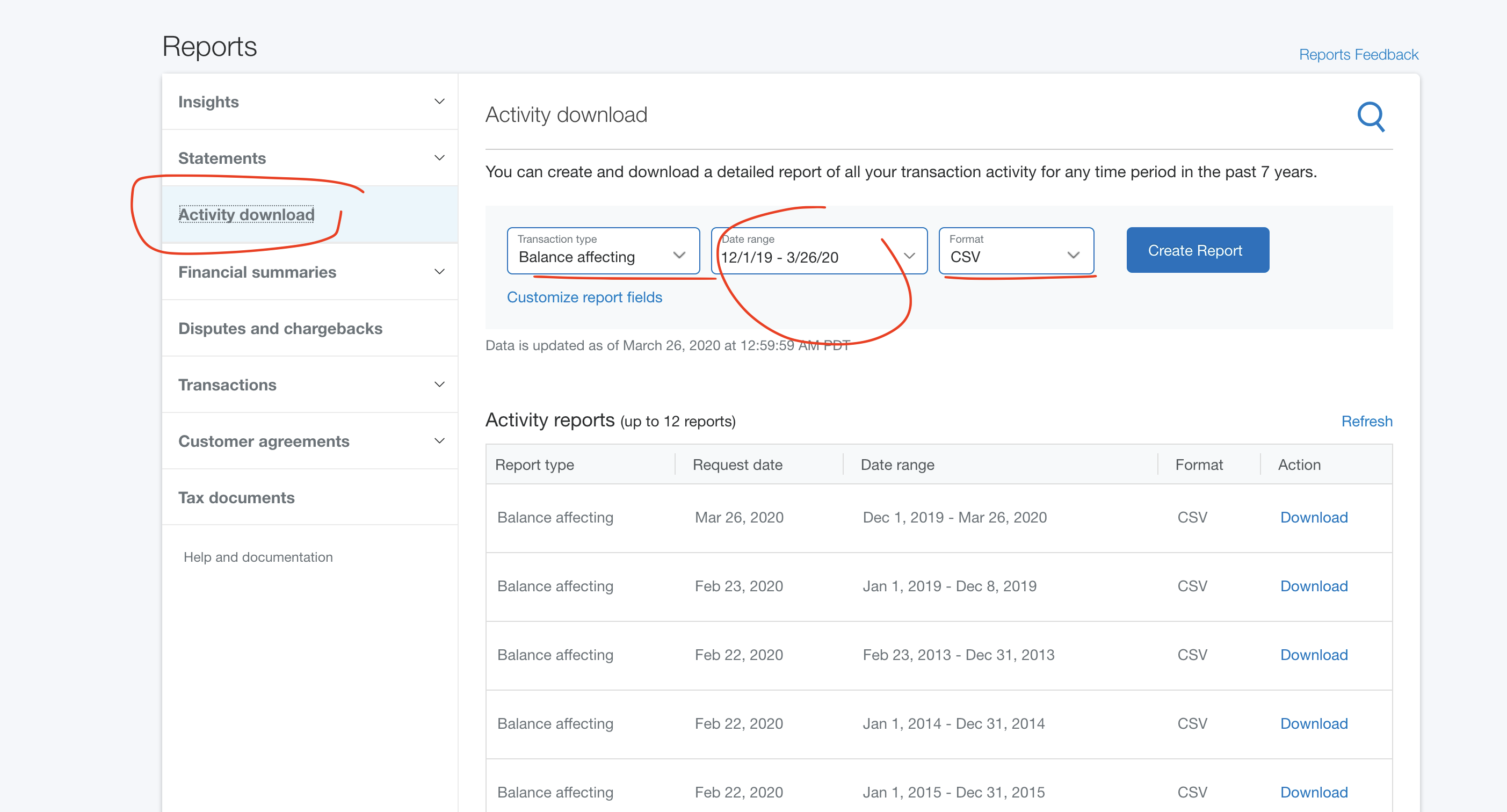

- In Stripe, for the pertinent month download the full report

- Select Report from top menu

- Select Financial Reports from left menu

- Select pertinent dates

- Download Balance change from activity

- Manually split out donations from book sales and BPCs.

- In Quickbooks, split out the monthly payout in donations, books sales, and subventions (minus fees). The number under donations will be a bit off (since the payout doesn't correspond exactly to the income over the entire month).

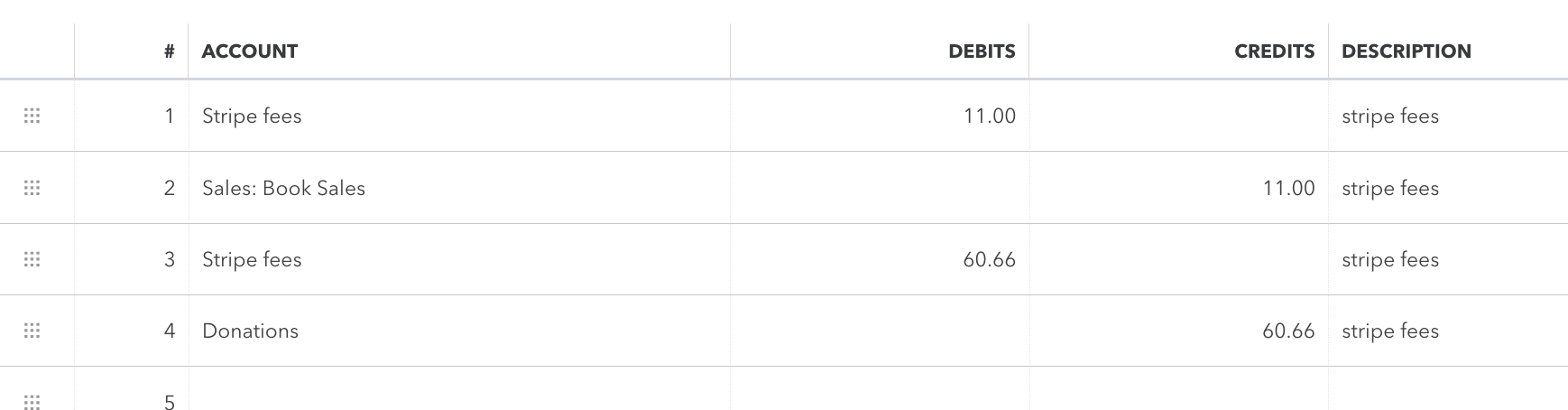

- Put in the fees separately as a journal entry set on the first of the previous month: DEBIT Stripe Fees, CREDIT Book Sales/Donations

Paypal Transactions in Foreign Currency

Outgoing Paypal transactions in foreign currency need to be added to Paypal manually, as they are not automatically ingested by Quickbooks. Do an activity download from Paypal covering the previous month, add payments in foreign currency manually as Expense from the Paypal Bank account. Add Paypal Fees separately as a Bank Charge.

M1 Investment Portfolio

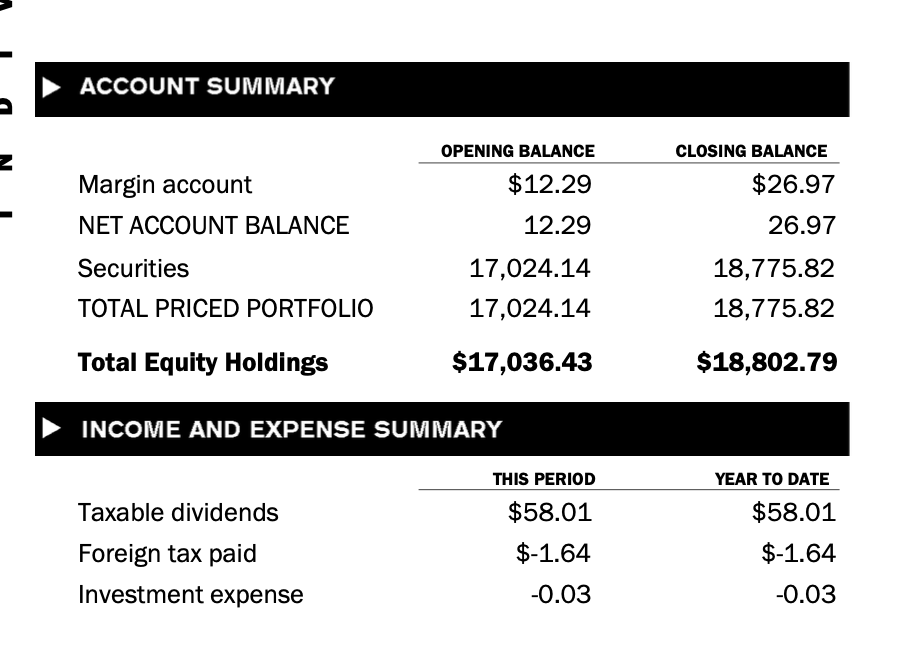

On the M1 Investment Portfolio backend go to Account > View Account Settings > Documents. Download the brokerage statement:

Implement as follows as a journal entry. Realized gains/losses is the difference in Total Equity Holdings minus dividends, taxes, and investment expenses.

From Realized Gains make sure to deduct any deposits made in that month.month, taxes, and investment expenses. Ignore substitute payments.