Monthly Accounting

Stripe Payouts

Stripe does a monthly payout, but this amount does not correspond logically to any subset of payments. Therefore, the following procedure is set up:

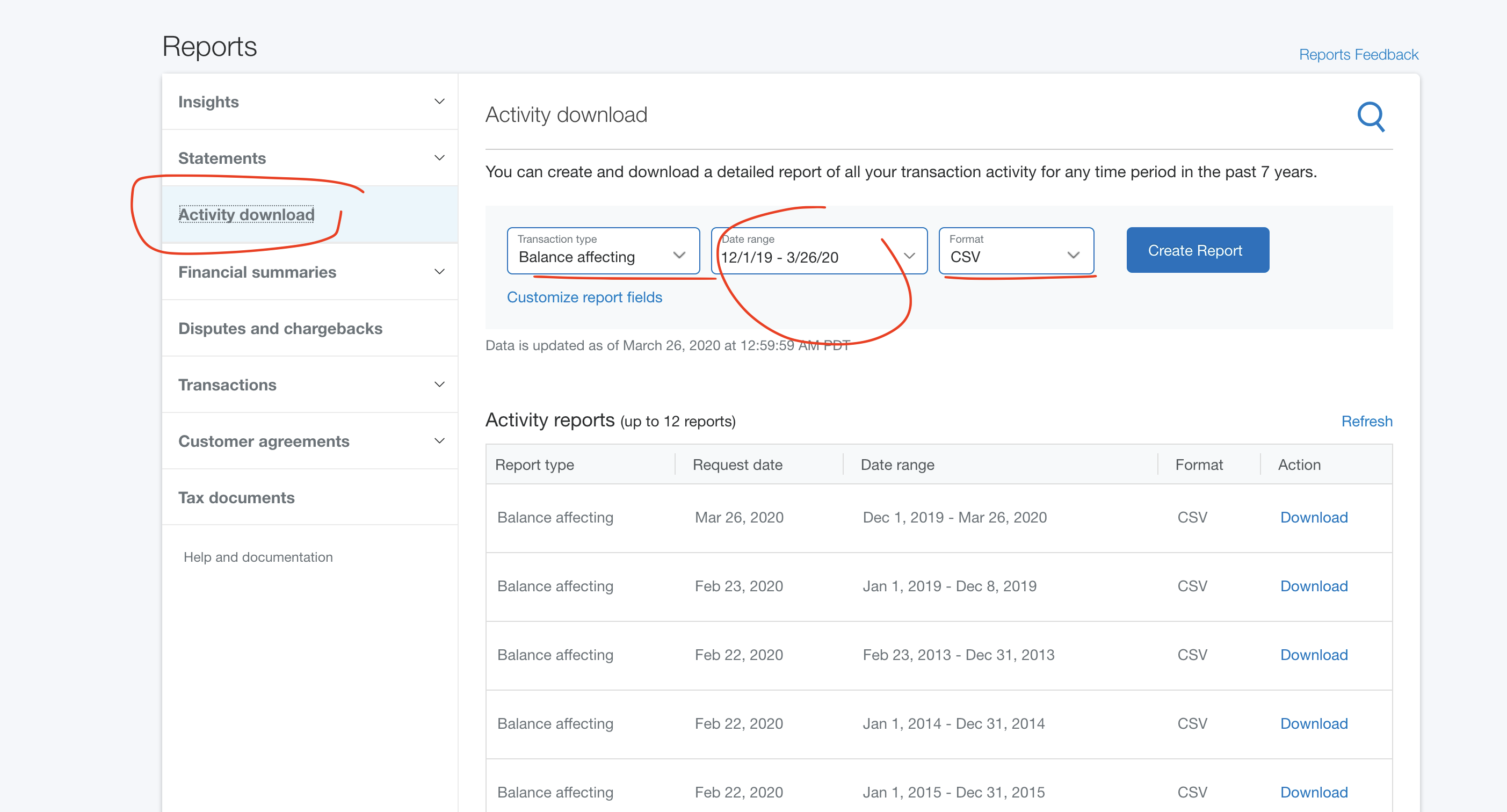

- In Stripe, for the pertinent month download the full report

- Select Reports from left menu (expand the …)

- Select Balance Summary

- Select pertinent dates

- Download Balance change from activity

- Manually split out donations from book sales and BPCs.

- In Quickbooks, split out the monthly payout in donations, books sales, and subventions (minus fees). The number under donations will be a bit off (since the payout doesn't correspond exactly to the income over the entire month).

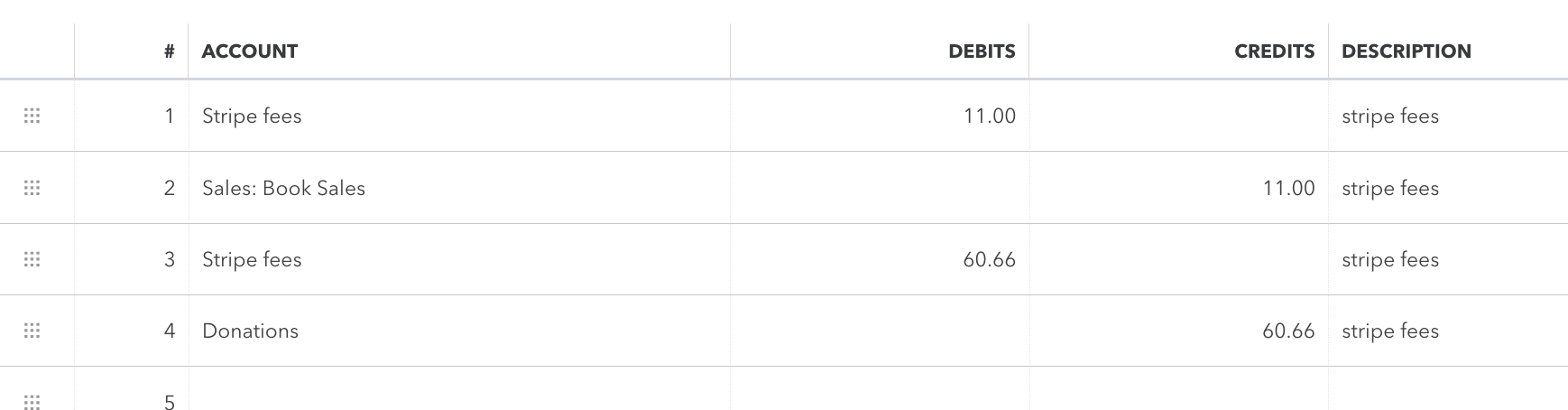

- Put in the fees separately as a journal entry set on the first of the previous month:

DEBIT Stripe Fees

CREDIT Book Sales/Donations

OBC Payouts

On a monthly basis, the Open Book Collective transfers funds to our account for library subscriptions. These include deducted OBC fees and development fund contributions. These need to be entered into Quickbooks separately as fees. Since the fees are deducted in different currencies, you first need to convert them into USD, using the date of the statement.

There is a spreadsheet of past payments: https://docs.google.com/spreadsheets/d/1_rkojrNIvW5NVR90KLD8lrbP05kmhzFymyNJTssqjPM/edit?gid=0#gid=0

- For the conversion rate of each currency, use the date of OBC payment notice and historic exchange rate on that date (or next non-bank holiday): https://www.x-rates.com/historical/?from=USD&amount=1&date=2025-04-05

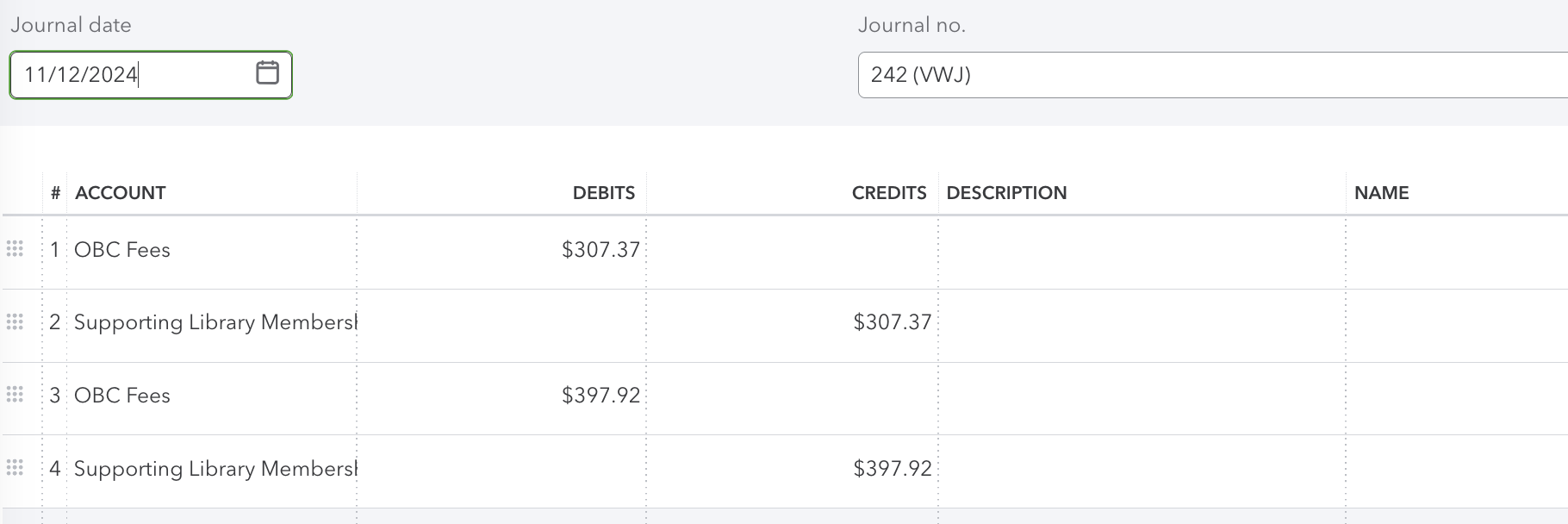

- Put in the fees separately as a journal entry set on the first of the previous month:

DEBIT OBC Fees

CREDIT Library Support

Amazon Payouts

On a monthly basis, Amazon pays out our book sales per Amazon domain/currency group. In the KDP backend, under Reports > Statements > Prior Months' Royalties you can download a monthly royalty report, listing all sales under the tab Paperback Royalty.

There is a spreadsheet of past payments: https://docs.google.com/spreadsheets/d/1V9VqdaJUb2iaHgC8eVM8wr5lXWviM6zL0Em-psOsO68/edit?usp=sharing

- Copy the ledger into the pertinent cells of the spreadsheet Data tab.

- In the Summary per Currency tab, copy the cells of the previous month, this will generate Total Book Printing Costs and Total KDP Fee per currency.

- The Total Summary tab gives the totals

- For the conversion rate of each currency, use the date of OBC payment notice and historic exchange rate on that date (or next non-bank holiday): https://www.x-rates.com/historical/?from=USD&amount=1&date=2025-04-05

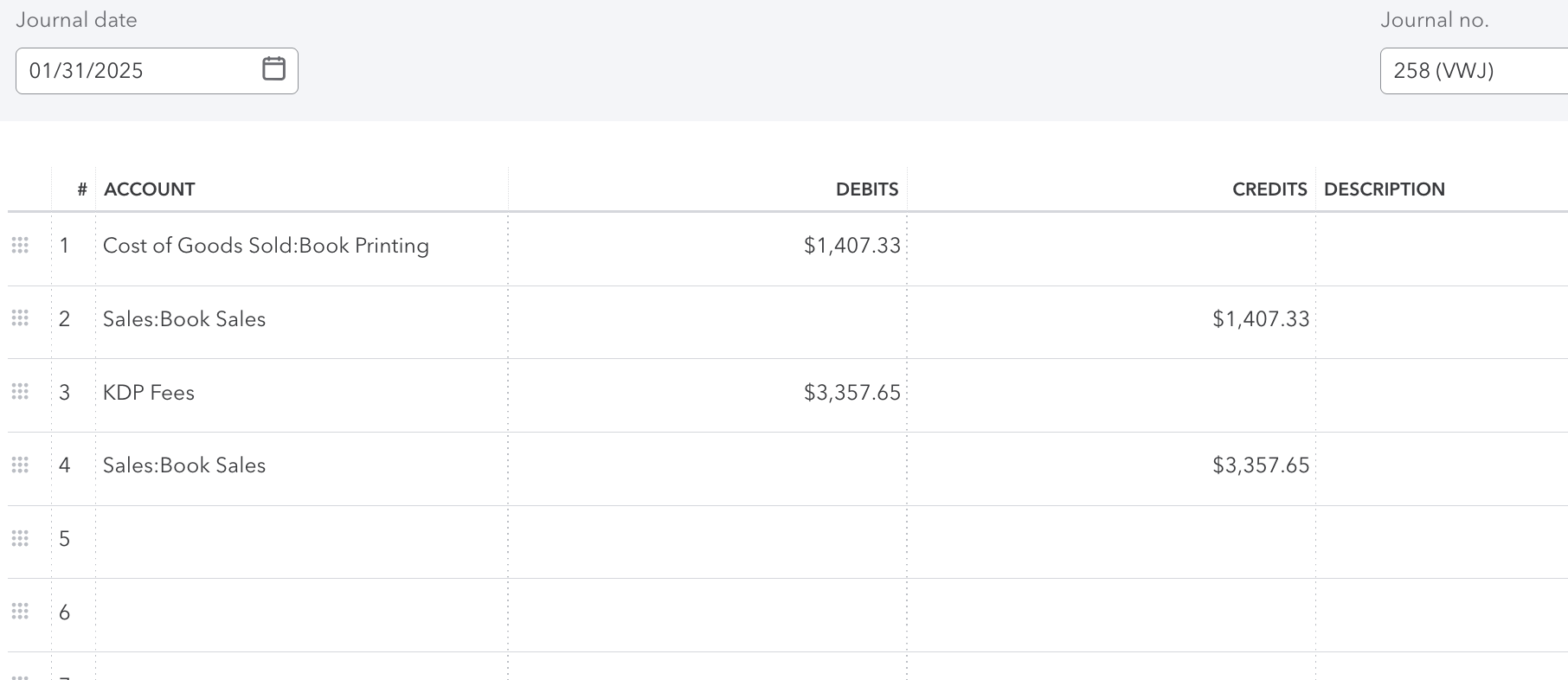

- Put in the fees separately as a journal entry set on the first of the previous month:

DEBIT KDP Fees / Book Printing

CREDIT Book Sales

Paypal Transactions in Foreign Currency

Outgoing Paypal transactions in foreign currency need to be added to Paypal manually, as they are not automatically ingested by Quickbooks. Do an activity download from Paypal covering the previous month, add payments in foreign currency manually as Expense from the Paypal Bank account. Add Paypal Fees separately as a Bank Charge.

M1 Investment Portfolio

On the M1 Investment Portfolio backend go to Account > View Account Settings > Documents. Download the brokerage statement:

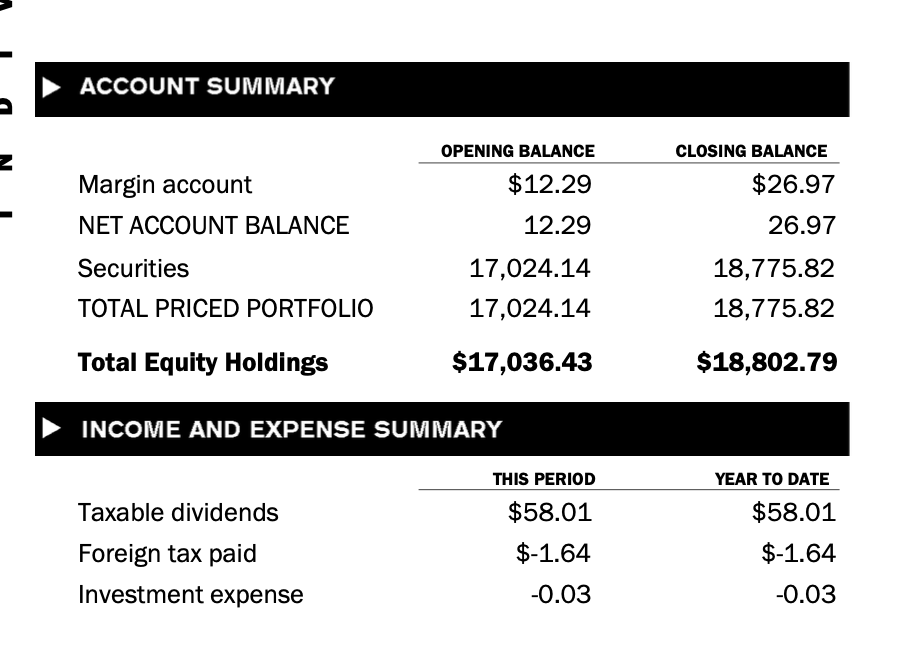

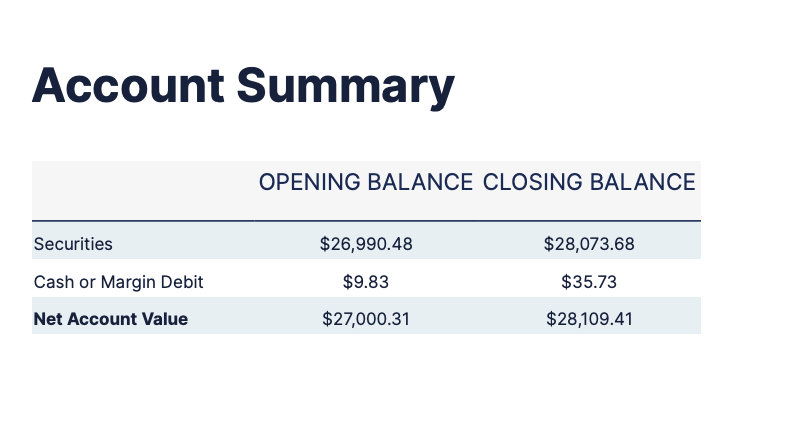

Implement as follows as a journal entry. Realized gains/losses is the difference in Total Equity Holdings minus dividends, any deposits made in that month, taxes, and investment expenses. Ignore substitute payments.

New format: